Hispanolistic/E+ by way of Getty Photographs

The week ending Dec. 9 noticed strain on shares forward of the Federal Reserve assembly this coming week. All 11 S&P 500 sectors completed within the crimson with the The Industrial Choose Sector SPDR (XLI) declining -3.19%. Vivint led industrial shares (on this phase) which additionally noticed two Chinese language airways as China eased up COVID restrictions following protests.

The SPDR S&P 500 Belief ETF (SPY) fell -3.35% for the week. The Fed is predicted to lift charges by 50 foundation factors however the feedback which can be made by Federal Reserve Chair Jerome Powell could be carefully watched as it will give an concept the place inflation and the well being of the economic system is heading. The November ISM Providers PMI Index turned larger than anticipated, whereas manufacturing unit orders climbed previous expectations in October. Labor productiveness additionally rose greater than anticipated in Q3. YTD, SPY is -17.20%, whereas XLI is -6.37%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +8% every this week. YTD, 4 out of those 5 shares are within the inexperienced.

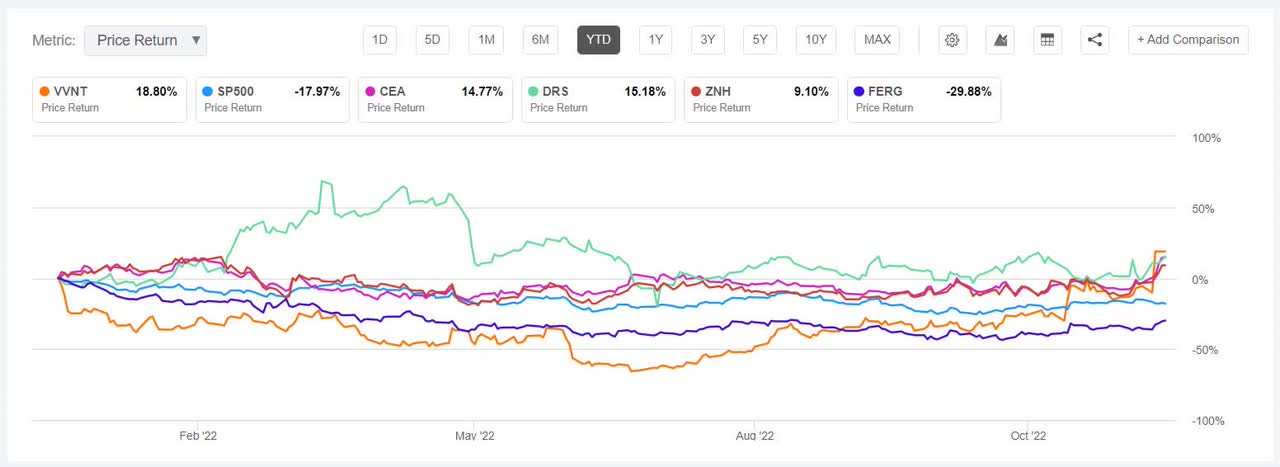

Vivint Good House (NYSE:VVNT) +25.98%. The inventory inventory shot up (+32.37%) on Dec. 6 after NRG Power (NRG) mentioned it was buying the Provo, Utha.-based sensible house and safety techniques supplier in $5.2B deal, which incorporates debt.

The SA Quant Ranking, which takes into consideration components akin to Momentum, Profitability, and Valuation amongst others, had a Maintain score on the shares. VVNT has an element grade of A for Profitability and D for Progress. The common Wall Road Analysts’ Ranking was Maintain as nicely, whereby 4 out of 5 analysts tagged the inventory as such. YTD, VVNT has risen +21.47%, essentially the most amongst this week’s prime 5 gainers.

China Japanese Airways (CEA) +18.46%. The inventory rose all through the week amid information that Industrial Plane Company of China, delivered its first domestically-developed passenger jet C919 to launch buyer CEA. YTD, the shares have climbed +15.95%. The SA Quant Ranking on the shares is a Maintain, with rating of A for Momentum and C+ for Valuation.

The chart under reveals YTD price-return efficiency of the highest 5 gainers and SP500:

Leonardo DRS (DRS) +15.65%. The Arlington, Va.-based firm mentioned it acquired a $39.5M contract award from the U.S. Military which propelled its inventory on Monday. The corporate, which supplies sensor and infrared techniques, has seen its inventory rise +19.21% YTD.

China Southern Airways (ZNH) +12.94%. The inventory made it to the highest 5 gainers for the second week in a row. The shares grew all through the week, and YTD have risen +10.32%.

Ferguson (FERG) +8.98%. U.Okay.-based plumbing and heating merchandise distributor Ferguson noticed its inventory rise after Q1 outcomes beat analysts estimates. The SA Quant Ranking on FERG is Maintain, with a D- rating for Progress and B- for Momentum. The common Wall Road Analysts’ Ranking differs with a Purchase score, whereby 3 out of 8 analysts view the the inventory as Sturdy Purchase. YTD, the inventory has declined -29.14%.

This week’s prime 5 decliners amongst industrial shares (market cap of over $2B) all misplaced greater than -11% every. YTD, all these 5 shares are within the crimson.

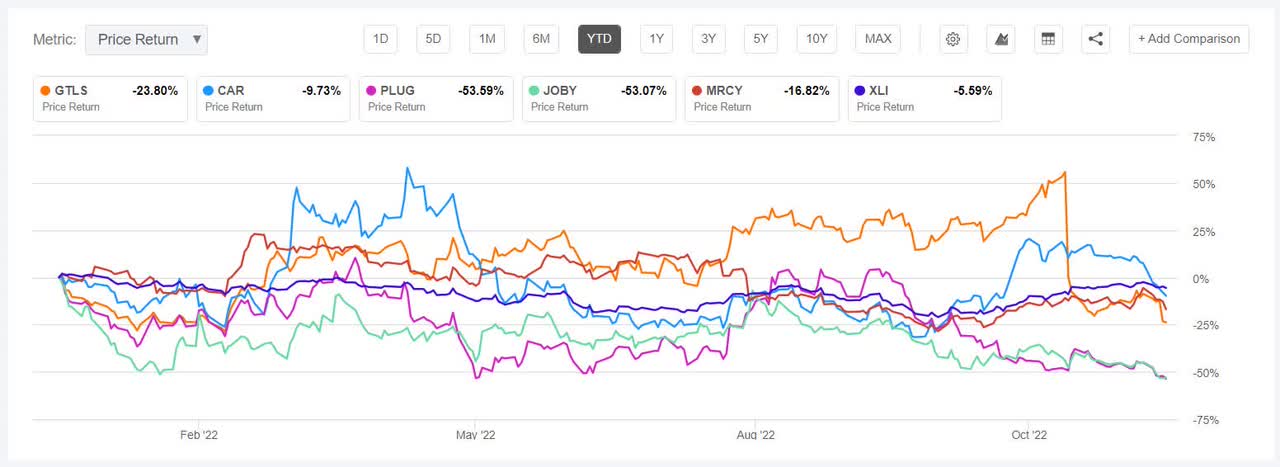

Chart Industries (NYSE:GTLS) -16.55%. The corporate’s shares slumped essentially the most on Thursday (-12.45%) after saying a inventory providing. Chart additionally priced a $1.97B debt providing within the week.

The SA Quant Ranking on the GTLS is Promote, with a rating of C for Profitability and D for Momentum. The common Wall Road Analysts’ Ranking is in full distinction with a Purchase score, whereby 11 out of 15 analysts tagging the inventory as Sturdy Purchase. YTD, the shares have dipped -26.52%.

Avis Funds (CAR) -15.99%. Susquehanna began protection on the Parsippany, N.J.-based automobile rental firm with a Impartial score with a cautious view. The inventory tumbled in all 5 periods, essentially the most on Monday (-9.59%). Avis was the highest performing industrial inventory of 2021 +455.95% (on this phase), nevertheless YTD, the shares have shed -11.97%.

The SA Quant Ranking on CAR is Maintain, with a rating of D for Progress and A- for Valuation. The common Wall Road Analysts’ Ranking concurs with a Maintain score of its personal, whereby 3 out of 6 analysts see the inventory as such.

The chart under reveals YTD price-return efficiency of the worst 5 decliners and XLI:

Plug Energy (PLUG) -15.50%. The Latham, New York-based firm was again amongst worst 5 performers after three weeks. YTD, PLUG has misplaced -52.67%, essentially the most amongst this week’s worst 5 decliners. The SA Quant Ranking on the shares is Promote, with a rating of F for Profitability and D- for Momentum. The common Wall Road Analysts’ Ranking differs with a Purchase, whereby 15 out of 30 analysts tagging the inventory as Sturdy Purchase.

Joby Aviation (JOBY) -15.01%. The Santa Cruz, Calif.-based electrical air taxi firm has taken a spot among the many worst 5 decliners after about two months. YTD, the inventory has fallen -51.92%. The SA Quant Ranking on the shares is Maintain, with a rating of C for Valuation and D for Momentum. The score is in distinction to the common Wall Road Analysts’ Ranking of Purchase, whereby 4 out of 6 analysts view the inventory as Maintain.

Mercury Programs (MRCY) -11.83%. The Andover, Mass.-based aero-defense firm has seen its inventory slip -14.20% YTD. The SA Quant Ranking on MRCY is Maintain, with Profitability carrying a rating of D+ and Progress A. The common Wall Road Analysts’ Ranking is Purchase, whereby 3 out of 10 analysts tag the inventory as Sturdy Purchase.