© Reuters.

By Olena Harmash

KYIV (Reuters) -Ukraine’s central financial institution saved its primary rate of interest unchanged at 25% on Thursday, and mentioned Russian missile strikes on vitality services had been set to hit GDP this 12 months and complicate a fast rebound by the financial system.

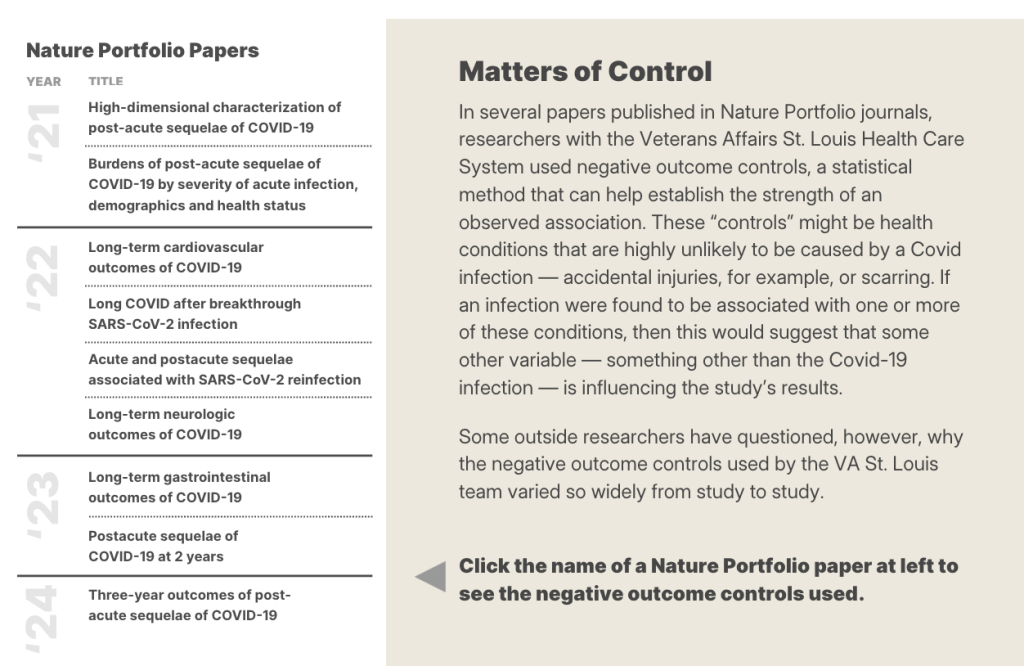

The central financial institution elevated the primary price to 25% in June to tame double-digit inflation as Russia’s invasion battered the financial system. The financial institution’s officers have since repeatedly mentioned they intention to maintain it at that stage till 2024.

Continued worldwide financing is a key prerequisite for financial stability, the financial institution mentioned in a press release after its final financial coverage assembly of the 12 months. Worldwide monetary support will attain $31 billion this 12 months, it mentioned.

“The primary dangers for financial improvement are an extended interval of full-scale army aggression by Russia, in addition to an additional improve in terrorist assaults in opposition to vital infrastructure services,” the assertion mentioned.

Russia, which invaded Ukraine in February, has elevated assaults on vitality services in latest weeks, with a lot of the nation experiencing extreme vitality shortages and lengthy blackouts.

“The autumn in GDP will probably be deeper this 12 months than we had anticipated in October,” deputy governor Serhiy Nikolaychuk informed a information briefing. “Subsequent 12 months the financial restoration will probably be very torpid and far decrease than we had anticipated.”

The central financial institution mentioned that client inflation had accelerated to 26.6% in October year-on-year.

The central financial institution’s present forecast sees Ukraine’s GDP falling by 31.5% this 12 months. The financial institution expects the financial system to return to progress in 2023, with GDP rising by 4%.

The Worldwide Financial Fund expects Ukraine’s GDP to fall by 35% this 12 months and that the financial system will stabilize subsequent 12 months.

The central financial institution additionally mentioned it was rising compulsory reserve necessities for business banks by 5 proportion factors.