Up to date on December twelfth, 2022 by Samuel Smith

Buyers trying to generate increased revenue ranges from their funding portfolios ought to take a look at Actual Property Funding Trusts or REITs. These are corporations that personal actual property properties and lease them to tenants or put money into actual property backed loans, each of which generate a gradual stream of revenue.

The majority of their revenue is then handed on to shareholders by dividends. You may see all 208 REITs right here.

You may obtain our full record of REITs, together with essential metrics akin to dividend yields and market capitalizations, by clicking on the hyperlink under:

The fantastic thing about REITs for revenue traders is that they’re required to distribute 90% of their taxable revenue to shareholders yearly within the type of dividends. In return, REITs usually don’t pay company taxes.

Because of this, lots of the 200+ REITs we observe provide excessive dividend yields of 5%+.

However not all high-yielding shares are automated buys. Buyers ought to rigorously assess the basics to make sure that excessive yields are sustainable.

Notice that whereas the securities on this article have very excessive yields, a excessive yield alone doesn’t make for a stable funding. Dividend security, valuation, administration, stability sheet well being, and progress are additionally crucial components.

We urge traders to make use of the evaluation under as informative however to do important due diligence earlier than shopping for into any safety – particularly high-yield securities. Many (however not all) high-yield securities have a big danger of a dividend discount and/or deteriorating enterprise outcomes.

Desk of Contents

You may immediately leap to any particular part of the article through the use of the hyperlinks under:

Excessive-Yield REIT No. 10: Chimera Funding Company (CIM)

Chimera Funding Company is an actual property funding belief (REIT) that could be a specialty finance firm. The corporate’s main enterprise is in investing by subsidiaries in a diversified portfolio of mortgage property, together with residential mortgage loans, Non-Company RMBS, Company CMBS, and different actual property associated securities.

Chimera’s revenue is predominantly obtained by the distinction between the corporate’s revenue on its property and financing and hedging prices. The corporate funds the acquisition of property by a number of funding sources: asset securitization, repurchase agreements (repo), warehouse strains, and fairness capital.

In early November, Chimera launched monetary outcomes for the third quarter of fiscal 2022. Its core earnings-per-share declined sequentially from $0.31 to $0.27 as a consequence of rising rates of interest and wider credit score spreads. The corporate is dealing with a powerful headwind from the surge in inflation and the resultant shift within the coverage of the Fed, which has begun elevating rates of interest aggressively to regulate inflation. An sudden enhance in rates of interest is a powerful headwind for Chimera, because it exerts nice strain on its margins, i.e., the distinction between lending and borrowing charges, with out permitting the corporate to hedge its charges.

Click on right here to obtain our most up-to-date Positive Evaluation report on Chimera Funding Company (CIM) (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 9: New York Mortgage Belief (NYMT)

New York Mortgage Belief is an actual property funding belief, or REIT, that acquires, invests in, funds, and manages mortgage-related property and different monetary property. The belief doesn’t personal bodily actual property however relatively seeks to handle a portfolio of investments which can be actual property associated. New York Mortgage Belief derives income from web curiosity revenue and web realized capital positive factors from its funding portfolio.

The belief primarily seeks to generate curiosity revenue from mortgage-related property, however it additionally owns some distressed monetary property the place it seeks to seize capital positive factors. The belief invests in residential mortgage loans, multi-family CMBS, most popular fairness, and three way partnership fairness.

New York Mortgage Belief reported third-quarter earnings on November 2nd, 2022, and the outcomes have been worse than anticipated for each income and earnings. The belief reported earnings-per-share of -$0.33, which was 23 cents worse than anticipated. Whole web curiosity revenue was $14.22 million, which was down by $54 million year-over-year and missed expectations by $12.8 million. The belief famous that the volatility in rates of interest within the latter levels of the quarter drove “sharply lowered” asset costs throughout the belief’s fixed-income markets. The belief, in response, halted asset purchases in consequence within the third quarter, which it believes helped improve the protection of the stability sheet.

Click on right here to obtain our most up-to-date Positive Evaluation report on New York Mortgage Belief (NYMT)(preview of web page 1 of three proven under):

Excessive-Yield REIT No. 8: AGNC Funding Corp. (AGNC)

American Capital Company Corp was based in 2008 and is a mortgage actual property funding belief that invests primarily in company mortgage-backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio includes residential mortgage pass-through securities, collateralized mortgage obligations (or CMO), and non-agency MBS. Many of those are assured by government-sponsored enterprises.

The vast majority of American Capital’s investments are fixed-rate company MBS. Most of those are MBS with a 30-year maturity interval. AGNC derives almost all its income within the type of curiosity revenue. It presently generates $1.2 billion in annual web income.

AGNC reported its Q3 2022 outcomes on October twenty fourth, 2022. It generated a $2.01 complete loss per widespread share. AGNC had a $9.08 tangible web guide worth per widespread share as of September 30, 2022, which decreased $2.35 per widespread share, or -20.6%, from $11.43 per widespread share as of June 30, 2022. AGNC paid out $0.36 in dividends per widespread share for the third quarter. There was a -17.4% financial return on tangible widespread fairness for the quarter, comprised of $0.36 dividends per widespread share and a $2.35 lower in tangible web guide worth per widespread share.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Corp. (AGNC)(preview of web page 1 of three proven under):

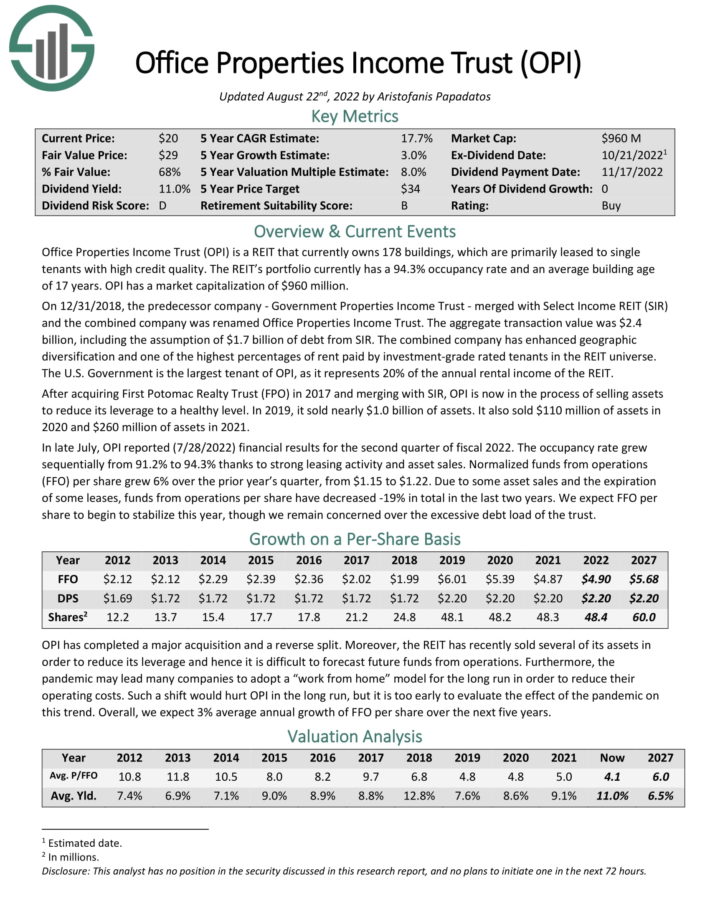

Excessive-Yield REIT No. 7: Workplace Properties Revenue Belief (OPI)

Workplace Properties Revenue Belief owns 178 buildings, that are primarily leased to single tenants with excessive credit score high quality. The REIT’s portfolio presently has a 90.7% occupancy fee and a mean constructing age of 17 years. The U.S. Authorities is the biggest tenant of OPI, because it represents 20% of the annual rental revenue of the REIT.

In late October, OPI reported (10/27/2022) monetary outcomes for the third quarter of fiscal 2022. The occupancy fee fell sequentially from 94.3% to 90.7% and normalized funds from operations (FFO) per share dipped -10% over the prior yr’s quarter, from $1.24 to $1.11. As a consequence of some asset gross sales and the expiration of some leases, funds from operations per share have decreased -19% in complete within the final two years. Given higher-than-expected asset gross sales, now we have lowered our annual forecast from $4.90 to $4.70. We additionally stay involved over the extreme debt load of the belief.

OPI generates the vast majority of its annual rental revenue from investment-grade tenants. This is among the highest lease percentages paid by investment-grade tenants within the REIT sector. Furthermore, U.S. Authorities tenants generate about 20% of complete rental revenue, and no different tenant accounts for greater than 4% of annual revenue. This distinctive credit score profile constitutes a significant aggressive benefit.

Alternatively, OPI has significantly elevated its debt load after its newest acquisition. Its web debt is extreme at about 11 occasions the annual funds from operations and a pair of.5 occasions as a lot as the present market capitalization of the REIT. Happily, OPI is within the means of promoting property, and therefore it’s more likely to drive its leverage to more healthy ranges within the close to future.

Click on right here to obtain our most up-to-date Positive Evaluation report on Workplace Properties Revenue Belief (OPI) (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 6: Sachem Capital (SACH)

Sachem Capital Corp is a Connecticut-based actual property finance firm specializing in originating, underwriting, funding, servicing, and managing a portfolio of short-term (i.e., three years or much less) loans secured by first mortgage liens on actual property property situated primarily in Connecticut.

Every of Sachem’s loans is personally assured by the borrower’s principal (s), usually collaterally secured by a pledge of the guarantor’s curiosity within the borrower. The corporate generates round $30 million in complete revenues.

On October twenty seventh, 2022, Sachem Capital decreased its quarterly dividend by a cent to $0.13 after beforehand elevating it by a cent to $0.14. That is nonetheless increased than final yr’s $0.12 quarterly fee. On November ninth, 2022, Sachem Capital Corp. introduced its Q3-2022 outcomes for the interval ending September thirtieth, 2022. Whole revenues through the quarter got here in at $13.5 million, up 58.9% in comparison with Q3-2021. The rise in income was primarily pushed by elevated lending operations, together with increased curiosity revenue and origination charges, as a result of firm increasing its funding portfolio over the previous 4 quarters. Web revenue was roughly $4.1 million, 20.6% increased than final yr’s. Nevertheless, EPS fell by a cent throughout the identical interval to $0.11 as a consequence of a better share rely for Sachem to fund its new originations.

Shifting ahead, there ought to be a number of key drivers to Sachem’s progress. First, regardless of the rise in rates of interest, Sachem believes there’s a important market alternative for a well-capitalized “laborious cash” lender to originate attractively priced loans to small and mid-scale actual property builders with good collateral.

Second, the aggressive panorama for Sachem stays favorable, as many banks and different conventional lenders nonetheless have restrictive lending standards and plenty of non-traditional lenders are under-capitalized.

Third, Connecticut’s residential actual property market, its main market, has stabilized and is kind of sturdy. Lastly, Sachem continues its growth past Connecticut and has a rising presence in different states, particularly in Florida and Texas.

Click on right here to obtain our most up-to-date Positive Evaluation report on Sachem Capital (SACH) (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 5: Annally Capital Administration (NLY)

Annaly Capital Administration, Inc., a diversified capital supervisor, invests in and funds residential and industrial property. The belief invests in numerous forms of company mortgage–backed securities, non–company residential mortgage property, and residential mortgage loans.

It additionally originates and invests in industrial mortgage loans, securities, and different industrial actual property investments. Annaly provides financing to personal fairness–backed center market businesses and operates as a dealer–supplier.

On October twenty sixth, 2022, NLY introduced its monetary outcomes for the third quarter. The belief registered a web lack of $0.70 per common widespread share for the quarter. Earnings accessible for distribution have been $1.06 per common widespread share for the quarter, leading to dividend protection of 120%. Total, the belief made an financial lack of 11.7% for the third quarter. The annualized GAAP return on common fairness was -9.9%, and the annualized EAD return on common fairness was 17.6%. The guide worth per widespread share was $19.94, and the GAAP leverage was 5.8x, up from 5.4x within the prior quarter. Financial leverage stood at 7.1x, up from 6.6x within the prior quarter. The board declared a quarterly widespread inventory money dividend of $0.88 per share.

Click on right here to obtain our most up-to-date Positive Evaluation report on Annally Capital Administration (NLY)(preview of web page 1 of three proven under):

Excessive-Yield REIT No. 4: Two Harbors Funding Corp. (TWO)

Two Harbors Funding Corp. is a residential mortgage actual property funding belief (mREIT). As such, it focuses on residential mortgage–backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and industrial actual property.

The belief derives almost all of its income within the type of curiosity by accessible–for–sale securities.

On November eighth, 2022. Two Harbors reported monetary outcomes for the third quarter with a guide worth of $16.42 per widespread share, representing a (16.2)% quarterly financial return on guide worth. It generated a Complete Lack of $287.8 million, or $(3.35) per weighted common fundamental widespread share, and reported Earnings Out there for Distribution (EAD) of $55.2 million, or $0.64 per weighted common fundamental widespread share. TWO declared a third-quarter widespread inventory dividend of $0.68 per share. GAAP debt-to-equity elevated to five.5x from 3.8x, and financial debt-to-equity elevated to 7.5x from 6.4x because the influence of the guide worth decline greater than offset a $1.6 billion decline within the firm’s Company RMBS and TBA place

Click on right here to obtain our most up-to-date Positive Evaluation report on Two Harbors (TWO) (preview of web page 1 of three proven under).

Excessive-Yield REIT No. 3: Orchid Island Capital Inc. (ORC)

Two Harbors Funding Corp. is a residential mortgage actual property funding belief (mREIT). As such, it focuses on residential mortgage–backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and industrial actual property.

The belief derives almost all of its income within the type of curiosity by accessible–for–sale securities.

On October twenty seventh, 2022, Orchid Island Capital reported Q3 outcomes. The corporate reported a Q3 Web lack of $84.5 million, or $2.40 per widespread share, which consists of Web curiosity revenue of $14.2 million, or $0.40 per widespread share. Whole bills of $5.2 million, or $0.15 per widespread share. Web realized, and unrealized losses have been $93.5 million, or $2.66 per widespread share, on RMBS and by-product devices, together with web curiosity revenue on rate of interest swaps. Guide worth per widespread share got here in at $11.42, whereas the entire return of -16.7% comprised a $0.545 dividend per widespread share and a $2.94 lower in guide worth per widespread share.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital Inc. (ORC) (preview of web page 1 of three proven under).

Excessive-Yield REIT No. 2: ARMOUR Residential REIT (ARR)

ARMOUR is a mortgage REIT that invests primarily in residential mortgage–backed securities that are assured or issued by a United States authorities entity, together with Fannie Mae, Freddie Mac and Ginnie Mae.

ARMOUR reported Q3 outcomes on October twenty sixth, 2022. It generated a complete lack of $(155.7) million or $(1.26) per widespread share. Distributable Earnings have been $38.8 million, representing $0.32 per widespread share. The REIT paid widespread inventory dividends of $0.10 per share per 30 days through the quarter and raised $167.2 million of capital by issuing 22,733,043 shares of widespread inventory at $7.36 web proceeds per share, after charges and bills. Administration has additionally repurchased 780,000 shares of widespread inventory at a mean price of $4.96 per share. Web curiosity revenue was $25.1 million, whereas the online curiosity margin of two.21% was down one foundation level from the prior quarter.

Guide worth per widespread share was $5.83, whereas complete liquidity was $469.3 million. The debt-to-equity ratio was 8.7 to 1, whereas leverage, web of TBA Safety quick positions, was 7.8 to 1. Implied leverage, adjusted for ahead settling gross sales and unsettled purchases, was 7.3 to 1. Curiosity Charge swap contracts totaled $6.5 billion of notional quantity, representing 90% of the entire repurchase settlement and TBA Securities liabilities.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT (ARR) (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 1: Broadmark Realty Capital (BRMK)

Broadmark Realty Capital Inc. is an actual property funding belief that gives short-term, the primary deed of belief loans which can be secured by actual property. Clients use these loans to amass, renovate, rehab, and develop properties for each residential and industrial makes use of within the U.S. Broadmark Realty was shaped in 2010 however had its preliminary public providing in November 2019.

On November seventh, 2022, Broadmark Realty reported third-quarter outcomes for the interval ending September thirtieth, 2022. For the quarter, income decreased 11.4% to $27.1 million, which was $1.42 million under estimates. The adjusted earnings per share of $0.14 in comparison with $0.16 within the prior yr have been $0.02 lower than anticipated. Quarterly curiosity revenue totaled $20.7 million, and charge revenue was $6.4 million. The full mortgage portfolio comprised $1.5 billion of loans throughout 17 U.S. states and the District of Columbia.

Broadmark Realty originated $137.9 million of latest loans and amendments for the quarter. Second quarter origination was a 30% lower sequentially and had a weighted common loan-to-value of 59.7%. As of September thirtieth, 2022, Broadmark Realty had a complete of $115.4 million of loans in contractual default. Provisions for credit score losses totaled $12.3 million in comparison with $2.6 million within the prior yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on Broadmark Realty Capital (BRMK)(preview of web page 1 of three proven under):

Closing Ideas

REITs have important attraction for revenue traders as a consequence of their excessive yields. These ten extraordinarily high-yielding REITs are particularly enticing on the floor, though traders ought to be conscious that abnormally excessive yields are sometimes accompanied by elevated dangers.

At Positive Dividend, we frequently advocate for investing in corporations with a excessive likelihood of accelerating their dividends every yr.

If that technique appeals to you, it might be helpful to flick through the next databases of dividend progress shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].