By Matthew Piepenburg

Beneath we observe years of determined but deliberate central financial institution bubble creation (and can-kicking) to its final end-game: titanic forex destruction.

The Bond Market is the Factor

When monitoring markets and asset lessons, one finally accepts the Shakespearean actuality that “the bond market is the factor.”

When a totally distorted world monetary system is pushed solely by the best credit score bubble (and therefore disaster) in historical past, the price of that debt (i.e., the rate of interest) turns into a major protagonist.

When charges are low, for instance, bubbles develop. When charges are excessive, they pop.

After all, the larger the bubble, the extra enjoyable the trip up; however conversely, the larger the bubble, the extra painful the pop.

And by the way in which: All bubbles (tech, property, credit score and forex) pop.

We at the moment are coming into that pop-moment, and the central bankers understand it, as a result of, nicely: They created it…

As soon as Upon a Time—Pure Forces

As soon as upon a time, there was an idea and even a dream of wholesome capitalism and pure market forces through which bonds had been pretty priced on the premise of a now extinct idea as soon as often known as pure provide and demand.

Nod to Adam Smith.

That’s, when demand for a bond was naturally excessive, its worth rose and its yield (and therefore fee) was naturally low; conversely, when demand was low, its worth fell and its yield (and therefore fee) rose.

This pure ebb and circulate of yields and therefore rates of interest saved credit score markets trustworthy.

As charges climbed and the price of debt rose, debt liquidity naturally slowed down and the system prevented itself from over-heating.

In essence, the bond markets had a pure stress gauge which triggered a pure launch of the recent air inside a bubble.

Then Got here the Un-Pure and the Dishonest

Then got here the un-natural central bankers towards which our founding fathers and Structure warned.

Like all the pieces centralized and human, versus pure, these short-sighted bankers ruined, nicely: all the pieces.

Fairly than permit bonds, yields and therefore charges to be decided by pure worth forces, these banks had the boastful concept that they may management such forces, the hubris equal of a sailor trying to manage the powers of an ocean.

Nod to John Smith of the Titanic.

The Enjoyable Half

For years, central bankers have artificially supported sovereign bond markets by buying in any other case undesirable bonds with cash created out of skinny air.

This absurd but well-liked “resolution” of repressed charges created bubble after bubble. That was the enjoyable half.

Additionally it is the half which breeds a college of educational apologists and theories (nod to MMT) who justify and defend the identical as an unsinkable market.

Bear in mind Janet Yellen’s declare that we might by no means see one other recession? Or Bernanke’s Nobel-Prize successful statement that we might print trillions at “no value” to the economic system?

In the meantime market members, having fun with the tailwinds of low charges and simple/low cost entry to debt, ignore the bubble risks (i.e., icebergs) forward as they benefit from the admittedly enjoyable a part of a rising bubble.

And oh, what enjoyable a cheap-debt-driven and artificially managed sequence of cheap-debt-induced bubbles will be…

Just like the tuxedo-clad 1st class passengers on the Titanic’s A-Deck, buyers (the highest 10% who personal 90% of inventory market wealth) cross cigars and brandy amongst themselves and speculate like youngsters evaluating portfolios, all of the whereas ignoring the rising iceberg off the bow.

How Icebergs Are Made

In terms of making icebergs, our central banks have an ideal file, and the chief of this pack is the U.S. Federal Reserve, a non-public financial institution which is neither Federal nor a reserve.

Simply saying…

For these paying consideration fairly than passing cigars on the A-Deck, you’ve already observed this sample of bubble-to-bubble and therefore debt iceberg to debt iceberg creation earlier than.

The Fed, with the complicit help of the business bankers and policymakers, for instance, “solved” the tech bubble of the late 90’s (kudos to Greenspan) which popped in 2000 by creating an actual property bubble which popped in 2008.

Via the identical playbook of synthetic fee suppression, the Fed then “solved” that housing bubble (kudos to Bernanke) by creating a world sovereign debt bubble/iceberg (kudos to Yellen and Powell), the very A-Deck upon which all of us stand right this moment.

Right now’s Iceberg: A International Credit score Disaster

Having purchased time and bubbles, from tech to housing to sovereign bonds, the Fed is now working out of locations to cover its newest iceberg. This sort of can-kicking is extra like sin-hiding.

Having squeezed a tech bubble into an actual property bubble, after which an actual property bubble right into a sovereign debt bubble, the place can the central bankers now cover their newest Frankenstein, bubble and iceberg? (I really like metaphors.)

The Foreign money Bubble

For me, no less than, the reply is pretty clear.

The one strategy to cover and “remedy” the best sovereign bond iceberg (disaster) in historical past is to bury it beneath wave after wave of mouse-clicked, debased and therefore more and more nugatory fiat currencies.

In brief, the Fed will cover its newest credit score bubble behind the final and solely bubble it has left in a history-confirmed sample utilized by all failed monetary regimes, specifically: Making a forex disaster (i.e., debased cash) to unravel a debt disaster.

After all, when you learn that final line (in addition to centuries of financial historical past) appropriately, this simply means there aren’t any options left, only a alternative of disaster choices: drowning bonds or drowning currencies.

Choose Your Poison: Credit score Disaster or Foreign money Disaster

Similar to the officers on the wheel of the Titanic had been the primary to comprehend their ship was sinking, the central bankers from DC to Tokyo are equally conscious that they had been driving too quick in a sea of icebergs.

Now, they’re struggling to “be calm” in voice as their crew scurries to rely unavailable lifeboats and hold the passengers from panicking too quickly.

Amongst this crew of coverage sailors on the monetary Titanic, two camps are forming. In any case, even when a ship is sinking, there may be all the time totally different expressions of the human intuition to outlive.

One camp is hawks. The opposite camp is doves. In fact, nevertheless, each camps are doomed.

Hawks Squawking

The hawks are telling the passengers (buyers) to worry not.

Sure, they’re elevating charges to struggle inflation, however this, they calmly say from the shivering A-Deck, is not going to trigger the worldwide credit score and therefore monetary markets to sink right into a contagious recession/melancholy.

That is the camp of Larry Summers, William Dudley, Jerome Powell and the likes of James Bullard on the St. Louis Fed.

Bullard, for instance, thinks a Fed Funds Fee of wherever from 5% to 7% might result in a mere “slowdown in progress” however in no way a recession.

Nicely, that’s wealthy. This coming from the identical workplace that mentioned inflation was “transitory” and a recession is just not a recession.

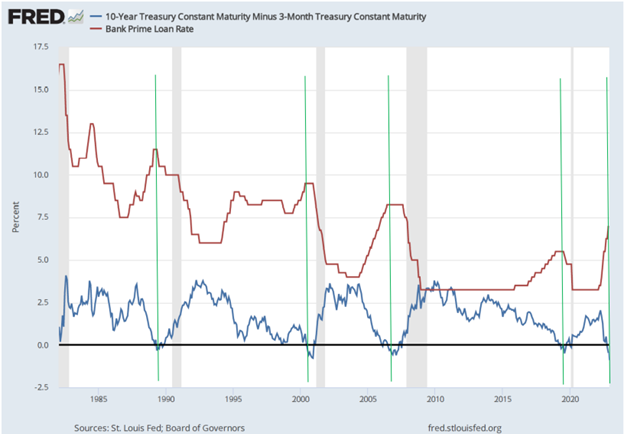

Based mostly on prior GDP prints and the inverted 3m/10y yield curve inversion of late, I’d argue we’re already in a recession, however then once more, why let details get in the way in which of a great lifeboat narrative.

Because the Fed captains all know, when the reality hurts, simply lie.

The hawks, it appears, someway consider that they’ll elevate charges (to as excessive as 7%) to kill mis-reported inflation (as excessive as 16%) [???] with out killing the credit score market.

Hmmm…

On the identical time, nevertheless, Powell wants inflation to outpace rates of interest to attain a deep sufficient slope of adverse actual charges to inflate away the USA’s $31T public debt.

Like Captain Smith on the Titanic, Powell is attempting laborious to remain calm however is aware of the tip recreation.

Lifeless Market or Lifeless Foreign money?

In brief, Powell is within the mom of all conundrums, dilemmas and self-made corners. He actually has no good choices left.

If he retains elevating charges to “struggle inflation”—he dangers sending the worldwide credit score markets beneath the cold-water line.

But when he pivots, eases or permits extra liquidity (i.e., QE) again into the bond markets, he saves the bonds however kills/debases the forex and therefore creates extra fairly than much less inflation.

Once more. Choose your poison: A lifeless bond market or a lifeless forex?

The Alternative Has Been Made

However in case the suspense is killing you, I’d say the reply is already in entrance of us.

As hinted above (and proven beneath), the one and final possibility left for debt-soaked regimes is forex debasement.

Historical past proves time after time after time that there aren’t any exceptions to this unhappy rule.

Regardless of his phrases on the contrary, Powell will in the end be pressured to kill the forex to allegedly save the credit score markets—thus as soon as once more squeezing one bubble (in credit score) into one other bubble (forex), which is what all of the central bankers have been doing for years: Pushing one bubble into the following till the ultimate one pops.

Said in any other case: There simply aren’t sufficient life boats for Captain Powell’s monetary Titanic.

Information Converse Louder Than Phrases

As I’ve argued all 12 months, Powell might speak Volcker-tough, however he’s transferring towards extra pretend liquidity and therefore extra inflationary cash printing.

When you assume in any other case, the proof is already earlier than us—and I’m not simply speaking about “moderating the tempo of fee hikes.”

So as to survive, the credit score markets want extra stability sheet enlargement (i.e., QE), which by definition, is inherently inflationary.

Nod to Milton Friedman.

Once more: Powell will select inflation (and forex debasement) over “combating” inflation, as a result of Powell secretly wants inflation and adverse actual charges to inflate away Uncle Sam’s bar tab.

Nod to Stan Fischer.

This finally means letting the USD develop in provide and therefore sink in worth.

Or acknowledged merely: A forex disaster.

Simply Observe the Sample/Banks

Towards this finish, the opposite main central banks and currencies of the world are already doing this.

The yen, euro and pound of 2022, for instance, have sunk to file lows to monetize native money owed—the USD will finally observe in 2023.

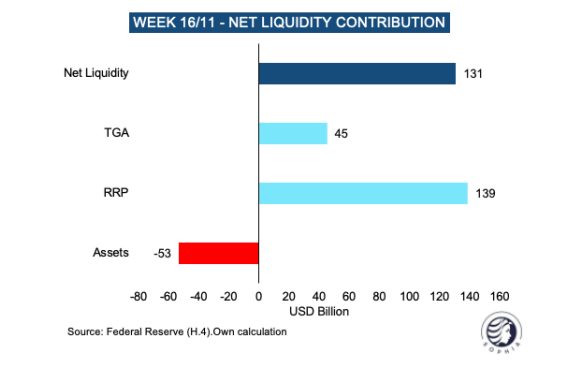

The truth is, this unstated desire for liquidity over “inflation combating” is already evident fairly than speculative.

As per the chart instantly beneath, November noticed $45B in Treasury spending and one other $139B in repo liquidity—for a complete of 131B in internet liquidity into the market, a quantity which far overshadows the $53B of so-called “QT” tightening by Powell.

In brief, one might converse like a hawk however act like a dove.

In the meantime, shares and bonds had been falling collectively.

Can all of us say: “Uh-oh”?

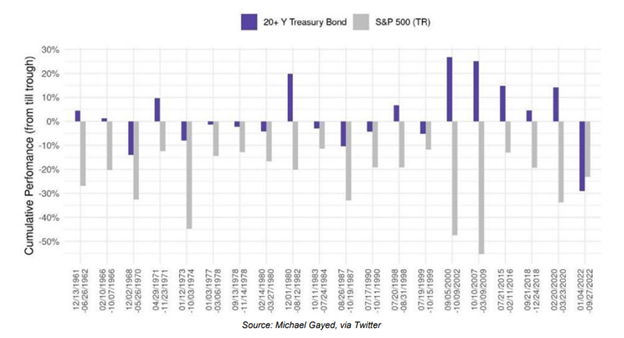

As per the bars on the far proper of the graph beneath, for the first time in 60years, we noticed a UST market (blue bar) fell quicker and additional than a top-20 inventory market drawdown (gray bar).

Hmmm. Can we blame this historic fall in USTs on inflation?

Nope.

Within the 1970’s, and as per chart above, we noticed inflation, however by no means USTs (blue bar) falling additional than shares.

Why the vital distinction right this moment?

Simple. Bonds are falling in worth as a result of demand is falling in reality. This bond drop is just not due to inflation, however as a result of nobody trusts the debtor—i.e., Uncle Sam.

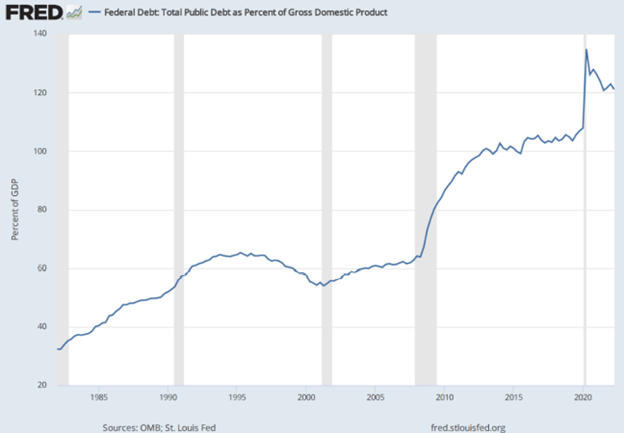

Not like the 70’s, US debt to GDP right this moment is at 125+%, and thus American IOUs right this moment simply aren’t what they had been yesterday.

…and financial deficits are at 10% of GDP.

That’s what I name a debt iceberg…The larger it will get, the lest buyers belief the debtor beneath the floor.

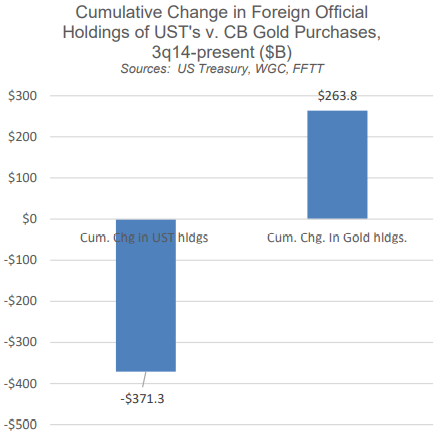

Towards this finish, overseas banks are turning their backs on Uncle Sam’s unloved USTs (IOUs)…

Frankly, I’ve by no means seen such a grotesque convergence of debt icebergs heading for our financial bow.

Watch the Currencies—They’re Already Drowning

As world central banks debase their currencies (yen, euro and pound) to monetize their unloved and unpayable sovereign money owed/bonds, we are able to count on extra volatility within the FX markets and pairings as the present USD, just like the bow of the Titanic, rises quickly excessive above the waves earlier than sinking deep, deep beneath them.

Can the Fed save that sinking greenback/Titanic by cranking up charges ala Powell on the expense of the US economic system and markets in addition to on the expense of its world associates and enemies who can’t pay again $14T value of USD-denominated money owed when the USD is simply too costly?

I feel not.

Nor am I alone in calling out this inconceivable dilemma of dangerous choices and dangerous bonds. Druckenmiller and Dimon are saying the identical factor.

Said merely, the one means present central banks can hold their unloved bond market afloat is by drowning their currencies in additional QE, which, evidently, will probably be excellent for gold…

This QE (at the moment hiding within the ignored repo markets) would be the final resort till the broadly telegraphed and pre-planned “nice [disorderly] reset” towards CBDC turns into the following embarrassing actuality.

This collective lack of religion in USTs and USDs is why world central banks are swapping out USTs and shopping for bodily gold…

As I’ve written and mentioned earlier than, it’s laborious to think about how we ever obtained to this apparent consequence of an excessive amount of debt and an excessive amount of synthetic, centralized “capitalism.”

Had been coverage makers sinister (i.e., deliberately making a pink carpet towards CBDC and extra whole management) or simply irretrievably silly?

Both means, the tip outcome is identical: The worldwide monetary system will sink, and although the USD often is the final to go below, below she’s going to go.