The cloud computing market witnessed accelerated progress within the final couple of years, as enterprises the world over shifted their digital property to cloud for making certain security and enhancing knowledge accessibility. However the digital transformation appears to be slowing down and cloud service suppliers have began feeling the pinch. Snowflake Inc. (NYSE: SNOW), a number one supplier of knowledge warehousing options, has been sustaining steady progress, supported by its distinctive multi-cluster shared knowledge structure.

The inventory market efficiency of the Bozeman-headquartered tech agency was not very encouraging this 12 months — the worth greater than halved since crossing $400 in November 2021 and hitting an all-time excessive. It has traded largely sideways within the second half. However, the inventory appears to be like poised to take off from right here, if the bullish outlook is any indication. Market watchers overwhelmingly advocate shopping for SNOW, citing the robust value goal that represents a 40% progress, based mostly on the final closing value.

Key Numbers

The October quarter was important for Snowflake as a result of it marked the corporate’s turnaround, after incurring back-to-back losses. Additionally, the bottom-line beat estimates for the primary time because it began reporting quarterly outcomes as a public entity, after a blockbuster public providing that’s touted as the most important IPO ever by a software program agency. Adjusted earnings greater than tripled to $0.11 per share from $0.03 per share final 12 months. On an unadjusted foundation, in the meantime, it was a web lack of $201.4 million or $0.63 per share, which is wider than the loss incurred within the prior-year quarter.

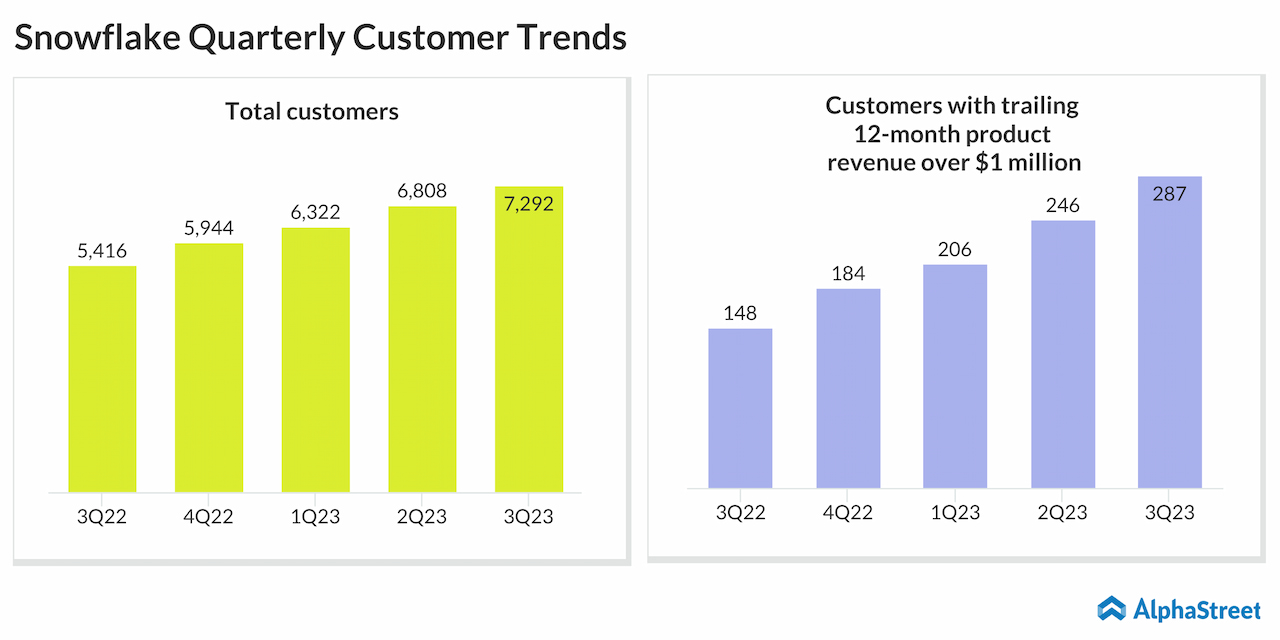

Remaining Efficiency Obligation, a measure of future efficiency obligations arising from contractual relationships — an vital gauge of the corporate’s monetary well being — jumped 66% from final 12 months to $3.0 billion within the third quarter. At $557.0 million, revenues had been up 67% and above the Road view. The corporate had 7,292 clients on the finish of the quarter.

Outlook

In a sign that the momentum would proceed within the remaining weeks of the 12 months, Snowflake’s executives predict that fourth-quarter product gross sales, which account for many of the whole income, would develop by 50% to about $535-540 million. However the constructive outlook didn’t impress the market a lot as specialists are in search of greater progress.

CrowdStrike: Why this cybersecurity inventory is an efficient funding for 2023

Within the present financial surroundings, Snowflake’s consumption-based pricing — not like others like Amazon Redshift which follows a subscription-based mannequin — doesn’t bode effectively for the corporate. Alternatively, the cloud market grew in double-digits in latest quarters regardless of the widespread slowdown. Although financial headwinds are forcing enterprises to chop down on know-how spending, they wouldn’t need to compromise on their cloud capabilities as a result of advantages they provide.

“For the total fiscal 12 months 2024, we count on product income progress of roughly 47% and non-GAAP adjusted free money move margin of 23%, and continued growth of working margin. This outlook features a slowdown in hiring, which we consider on a month-to-month foundation, however assumes including over 1,000 web new staff. Our long-term alternative stays robust, and we look ahead to executing. With that, operator, now you can open up the road for questions,” stated Snowflake’s CFO Mike Scarpelli in a latest assertion.

Investor sentiment improved since falling briefly following final week’s earnings report, and the inventory recovered. After closing the final session decrease, the shares skilled continued weak point throughout Monday’s session.