In this article

Tulsa, Oklahoma, is an exciting real estate market featuring strong population growth, job growth, and cash flow potential. The area has an excellent economic climate to support great investing returns well into the future.

Here, we’ll cover the following:

Home Prices

Rent Trends

Population, Labor Market, and Income

Cash Flow Potential

Winning Investment Strategies

Let’s get started.

Home Prices

As of October 2022, Tulsa’s median sales price is $194,700, and has a median days on market of 12 days.

After the Great Recession, Tulsa’s housing market took a long time to bottom out. Prices didn’t start to recover until 2012 after the national housing market saw increases. However, from March 2012 until today, prices have gone up 222%, according to the Case-Shiller Index.

Although conditions in the housing market nationwide are pointing toward a slowdown or reversal of appreciation, Tulsa remains in a relatively strong position.

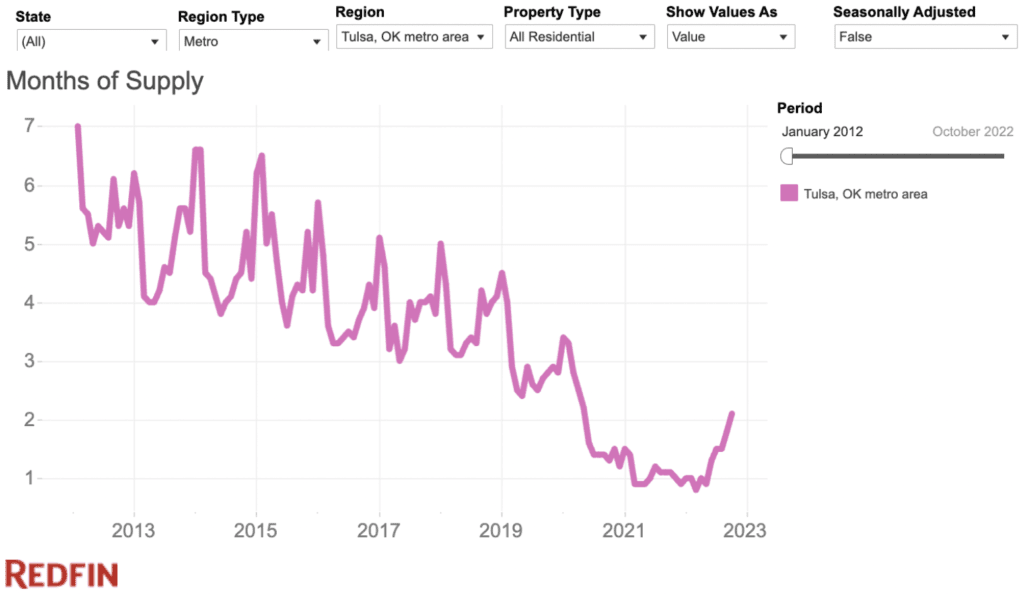

A good way to measure the strength of a housing market is through months of supply. When months of supply is up, it’s a buyer’s market. When months of supply is low, it’s a seller’s market.

As you can see in the graph below, months of supply have risen sharply from the extreme lows of the pandemic years but is far from pre-pandemic levels, at least not yet. This suggests that Tulsa remains in a fairly balanced housing market as of writing. It’s impossible to say what will happen to prices in the coming year or so, but relatively speaking, Tulsa is well-positioned to sustain a housing market correction compared to other markets in the U.S.

Rent Trends

After years of stagnating rent, Tulsa saw a rapid increase in the median rent price from late 2020 through today. From September 2020 through November 2022, the median rent went up a staggering 37%.

Although rents could fall in a recession or economic downturn, rents tend to be relatively sticky and have not fallen nearly as much as home prices historically. Given Tulsa’s strong economic and population growth over the last several years, it’s unlikely rent will fall much, if at all, even during a recession.

Population, Labor Market, and Income

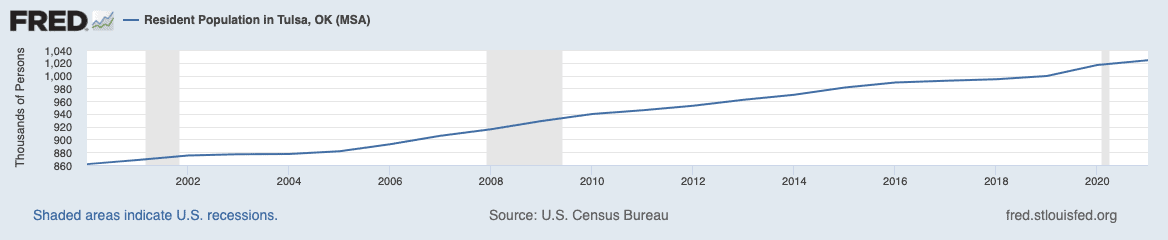

Tulsa boasts a fast-growing population, with Tulsa County growing nearly 11% from 2010 to 2020 and another 0.5% from 2020 to 2021. This sustained population growth means demand for houses and rental properties will likely remain strong well into the future.

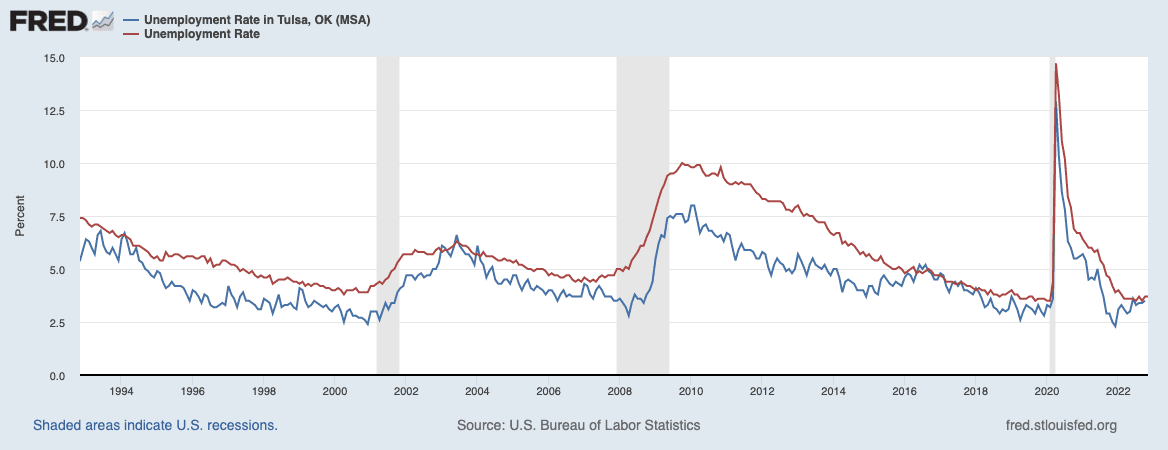

One of the variables in Tulsa’s recent economic growth is its improved labor market conditions. Looking at the chart below, you can see that for most of the last 30 years, Tulsa’s unemployment rate exceeded the national average by a relatively large margin. However, starting around 2016, employment in Tulsa came much more in line with the national average.

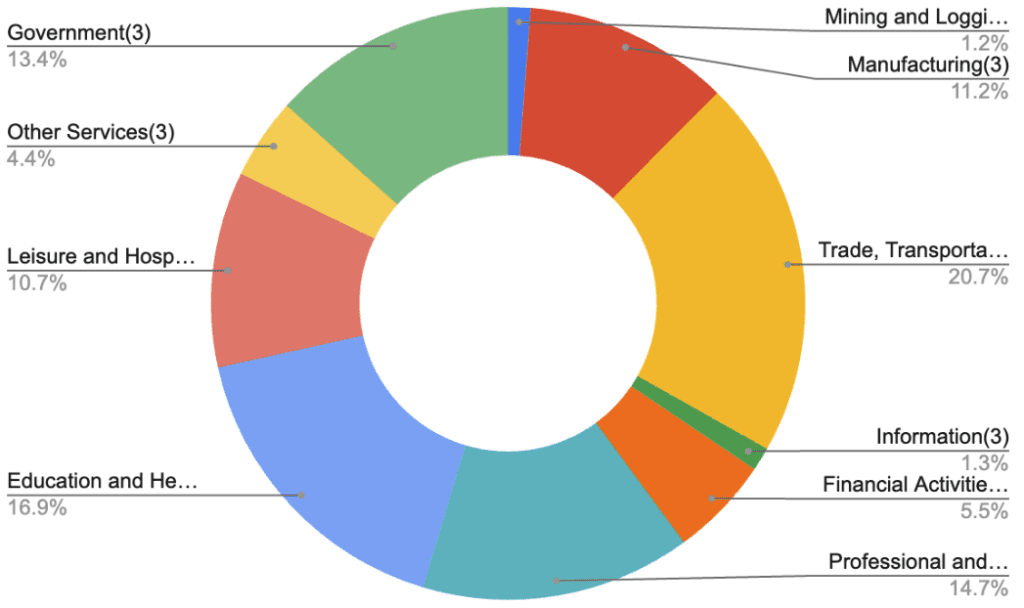

Much of this improvement is driven by Tulsa’s labor market diversification. For decades, Tulsa was highly dependent on the oil and gas industry, which often experienced boom and bust periods. However, as seen in the chart below, Tulsa now has a relatively well-diversified economy. Government, education, health, professional services, and trade are all well represented in Tulsa.

The median income is about $57,000, slightly below the national average of $65,000, but income has been growing steadily over the last few years.

Cash Flow Potential

With prices across the country skyrocketing over the last several years, many real estate investors have had a hard time finding cash flow. However, Tulsa offers fairly strong cash flow potential.

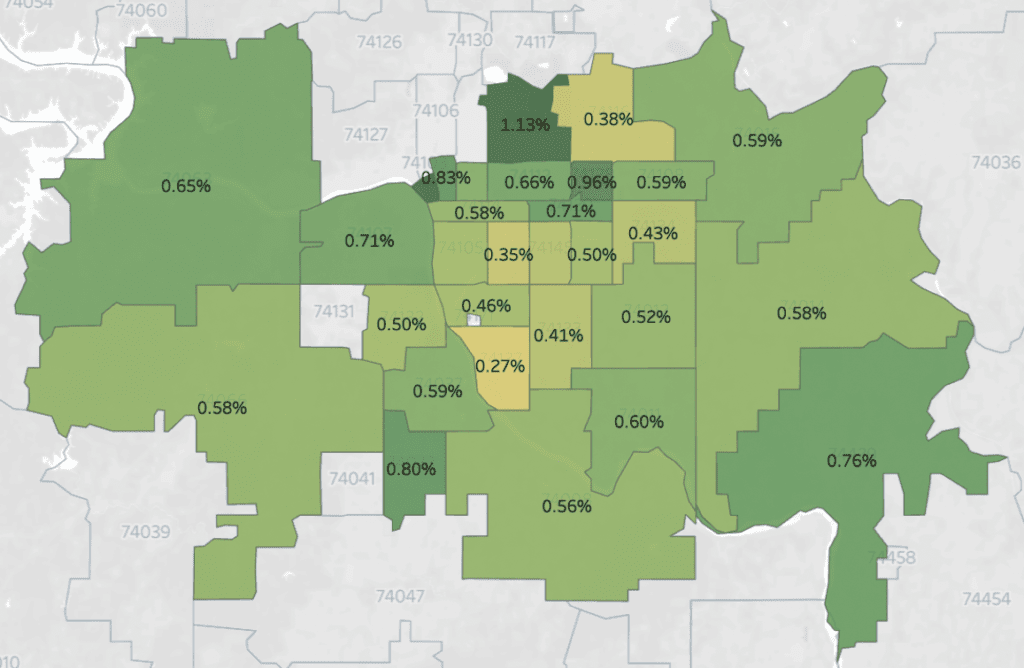

One of the best ways to estimate cash flow at a high level is to look at an area’s rent-to-price ratio (RTP). Generally speaking, the higher the RTP, the better. Anything with an RTP close to 1% is considered an excellent area for cash flow, but it’s not a hard and fast rule. You could find good deals in an area with an average RTP of 0.6%!

Remember, these numbers are just the average, which, by rule, means some deals offer RTPs above and below that number. It’s the investor’s job to find the best deals.

Winning Investment Strategies

According to real estate agent and Tulsa expert Dahlia Khalaf, a variety of strategies work in Tulsa, but she recommends traditional buy-and-hold investing. She’s noticed an oversaturation of short-term and medium-term rentals, but cash flow is strong for traditional rental properties.

Given the population growth, economic stability, and cash flow prospects of Tulsa, rental property investing is an excellent strategy in the area.

Find a Tulsa Agent in Minutes

Connect with market expert Dahlia Khalaf and other investor-friendly agents who can help you find, analyze, and close your next deal:

Search “Tulsa”Enter your investment criteriaSelect Dahlia Khalaf or other agents you want to contact

Conclusion

To learn about investing in Tulsa, partner with a local investor-friendly real estate agent like Dahlia Khalaf, who can help you find, analyze, and close the right deal.

Here’s how to contact Dahlia on Agent Finder. It’s easy:

Search “Tulsa”

Enter your investment criteria

Select Dahlia Khalaf or other agents you want to contact

Dahlia brings over 15 years of agent experience to the table. She specializes in helping investors like you build a team of experts that will catapult you to your goals. An active investor and well-connected Tulsa native, she took her portfolio from zero to 30 doors in only five years—and can help you do the same.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.