I literally can’t conceive of a world without banks. They give us a safe place to store our cash, facilitate fast electronic payments to people and businesses thousands of miles away, and lend us money to finance big purchases we can’t afford all at once.

I’ve had checking or savings accounts with about a dozen banks in my lifetime. I know others who’ve had relationships with even more — folks who hop from bank to bank to take advantage of lucrative new account bonuses.

The fact that regular consumers like us can open new bank accounts at will led me to wonder: How many banks are there in the United States? As it turns out, this question has a short, straightforward answer and a longer, more interesting one.

How Many Banks Are There in the U.S.?

There are currently 4,844 insured commercial banks, according to the Federal Deposit Insurance Corporation (FDIC).

This figure is current as of the end of 2021. The FDIC reports a new insured bank count every year, and next year’s number is almost certain to be different.

Which Types of Financial Institutions Are in the FDIC’s Count of U.S. Banks?

When we talk about the number of FDIC-insured banks in the United States, we’re talking about two types of institutions: commercial banks and savings banks, also known as thrifts.

Commercial banks are what most people think of when they hear the term “bank.” Commercial banks offer deposit accounts to consumers and businesses: checking accounts, savings accounts, and certificates of deposit. They make secured loans, such as mortgages and car loans. Many also offer unsecured credit products like credit cards and personal loans. They earn money from the spread between the higher interest rates they charge on loans and the lower interest rates they pay on customer deposits.

Savings banks also offer deposit accounts, make loans, and earn money on the interest rate spread. However, they have some fundamental limitations. They focus more on consumers than businesses, sometimes exclusively. And they make fewer types of loans — often just mortgages. On the bright side, they tend to pay higher interest rates on savings deposits.

Many commercial banks and savings institutions don’t openly advertise which type they are, so you might not know offhand which category the institutions you work with belong to. That said, the category doesn’t directly affect your experience as a user.

Both commercial and savings banks carry FDIC insurance on deposit accounts. If an FDIC-insured bank fails, the FDIC steps in to make its customers whole (up to dollar limits set by law). The current FDIC insurance limit is $250,000 per account type per institution.

Which Types of Financial Institutions Are NOT in the FDIC’s Count of U.S. Banks?

The FDIC’s count does not include credit unions. The National Credit Union Administration insures credit unions and tracks them separately.

It also doesn’t include fintech apps that aren’t chartered as banks or directly insured by the FDIC. However, fintech apps that accept fiat money deposits (old-fashioned U.S. dollars rather than cryptocurrencies) generally partner with banks that have national charters and FDIC insurance. Otherwise, most users wouldn’t trust them to keep their money safe.

Which States Have the Most Banks?

The five states with the most banks as of 2021 are Texas, Illinois, Iowa, Minnesota, and Missouri. All have more than 200 banks.

The five states with the fewest banks are Alaska, Hawaii, Vermont, New Hampshire, and Maine. If Washington, D.C., were a state, it would be in the bottom five.

These numbers refer to the number of FDIC-insured commercial and savings banks chartered in or headquartered in that state. Some banks, known as national banks, have nationwide charters not tied to a particular state. But every national bank has a designated headquarters location. For example, JPMorgan Chase, the country’s largest bank by asset size, is headquartered in Columbus, Ohio.

The number of individual bank branches in each state (and the country) is much higher. There are 4,236 FDIC-insured commercial banking institutions in the U.S. as of 2021 but 72,166 commercial bank branches. Most banks have at least one physical branch, and some have dozens or hundreds.

Relationship Between State Population & Number of Banks

There isn’t a strong relationship between state population and the number of banks chartered or headquartered in that state.

Of the top five states by bank count, Texas is second by population and Illinois is sixth. Iowa, Minnesota, and Missouri are 31st, 22nd, and 18th, respectively.

And Texas and Illinois are outliers among big states. Four of the top six states by population have far fewer banks. California has 127, Florida has 93, New York has 89, and Pennsylvania has 87.

Community banking offers a partial explanation for why some smaller states have more “native” banks than some larger states. Community banks tend to be smaller and more localized, with many operating only one or two branches. They’re also more vulnerable to recession, regulation, and competition than big banks, so their number has been declining for decades.

Since the 1980s, the Number of Banks in the U.S. Has Declined

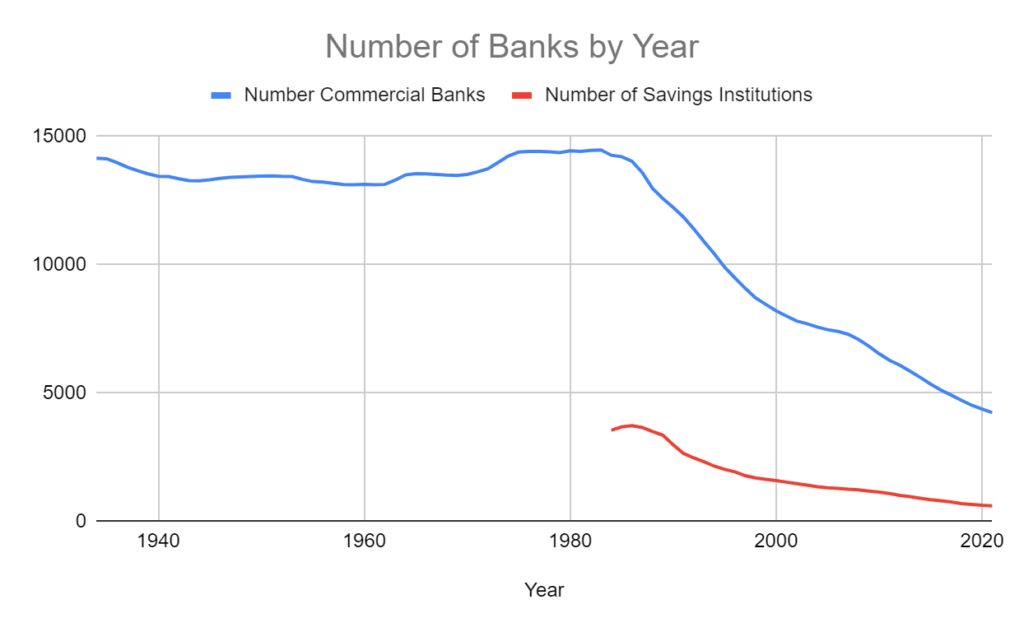

The FDIC began counting the number of commercial banks in 1934. That year, 14,146 commercial banks were operating in the United States.

That number didn’t change much for the next 50 years. After a low of 13,114 in 1959, the U.S. commercial bank count climbed to an all-time high of 14,469 in 1983. The following year, the FDIC began tracking the number of savings banks. The inaugural count was 3,550, for a total of 17,810 commercial and savings banks in the United States.

The U.S. population nearly doubled from 1934 to 1984, so while the number of U.S. banks per capita declined during this period, the industry appeared more or less stable. In other words, new banks formed about as quickly as old ones failed or merged.

Then, in the mid-1980s, something changed.

The number of active banks in the U.S. dropped by nearly 6,000 in just 10 years, from 17,754 in 1986 to 11,929 in 1995. This drop coincided with the savings and loan crisis of the late 1980s when thousands of smaller banks went belly-up as real estate prices and mortgage origination activity declined.

But the number kept dropping. In economic boom times and recessions alike, the number of banks in the U.S. fell every year after 1995. Meanwhile, the number of newly chartered banks (newly formed financial institutions) fell from 232 in 1999 to just 9 in 2021. In 2014 and 2016, no new banks came into being.

Why Is the Number of Banks in the U.S. Falling?

Three factors explain the decline in the number of banks operating in the U.S.: bank failures, bank mergers, and the lack of new banking charters.

Bank Failures

Bank failures tend to happen in waves, and they’re often tied to economic conditions. For example, interest rates rose rapidly during the early 1980s. Smaller thrift banks had no choice but to pay higher interest rates to attract new deposits — in some cases, higher than the rates on the fixed-interest mortgages they’d issued not long before. Bleeding money and unable to offload low-interest mortgages no other banks wanted, more than 1,000 thrifts failed by the end of the 1980s.

The Great Recession of the late 2000s caused a smaller wave of bank failures with a few high-profile victims. These banks borrowed to the gills to buy mortgage-backed assets that turned out to be worthless, and when the bill came due, they couldn’t bear the losses.

The good news is the bank failure rate has trailed off since then. It’s extremely low by historical standards, and even the violent economic shock of the COVID-19 pandemic didn’t do much to alter the trend.

Bank Mergers

Since the FDIC began keeping records, the general trend in the banking industry has been toward consolidation. Bigger banks needed to buy smaller banks to keep growing, and smaller banks often found it easier to sell than deal with state and federal regulations.

Conditions have been even more difficult for small banks since the Great Recession, which prompted a new wave of federal regulation and faster growth of online banks. Stricter federal regulation is a good thing for consumers. But it’s a major headache and financial drain for smaller banks that can’t spare the money and human resources to satisfy regulators’ requirements.

Online banking is arguably an even bigger threat to small banks’ independence. When you can do all your banking on your phone, why would you remain loyal to a local brick-and-mortar bank that can’t even match its digital competitors’ rates?

New Bank Charters

Dozens or hundreds of banks formed every year until the Great Recession. Since then, the pace has slowed to a crawl. In all but one year since 2010, newly chartered banks numbered in the single digits.

The most obvious reason for the drop-off is post-Great Recession regulation, but persistently low interest rates are also to blame. Banking just isn’t as profitable as it used to be, despite banks’ best efforts to devise creative new fees and surcharges.

Will the Number of Banks in the U.S. Continue to Decline?

Yes, the number of banks in the U.S. will likely continue to decline for the foreseeable future.

I don’t have a crystal ball. But I see no evidence of a change in the two conditions most responsible for today’s decline: ongoing consolidation among existing banks and a near-absence of newly chartered banks.

Eventually, the supply of smaller banks will dry up, and bigger banks will have fewer acquisition targets.

We’re a lot farther away from that point than it might seem, though. Canada has about 80 banks (including a couple dozen foreign-based banks) serving roughly 40 million people, or about one bank per 500,000 people. By contrast, the United States has 4,844 banks serving 332 million people, or about one bank per 68,500 people.

Could new banks emerge at higher rates in the future? Maybe, but it seems unlikely. Strict regulation and competitive pressures have made life difficult for small banks for years. For a new generation of bankers to feel confident striking out on their own, something fundamental would have to change.

Higher interest rates will boost established banks’ profits, but probably not enough to change the financial calculus for new institutions. And the savings and loan crisis shows that super-high interest rates can actively harm smaller banks.

Besides, it costs a lot of money to start a new bank. The fact that billionaires like Elon Musk and Mark Zuckerberg would rather buy unprofitable social media platforms or double down on clunky virtual reality technology tells you everything you need to know about the relative risk and reward.

Final Word

If you pay attention to banking and financial news, you might be confused to learn the banking industry is in a seemingly permanent state of contraction. You hear about a new fintech app every week — maybe every day — and each seems to put its own spin on day-to-day money management.

You’re not wrong, but you’re also not getting the full story. Those apps aren’t banks. They’re slick mobile platforms that look and act like banks, but they don’t have banking charters and aren’t regulated in the same way as commercial or savings institutions.

Don’t worry. Every reputable fintech app has an FDIC-insured banking partner behind it, so your money is safe. Some — like MetaBank, WebBank, and Cross River Bank — might vaguely ring a bell. These partners pull double, triple, and quintuple duty (or more), so a handful of banks can support the entire supply of new fintechs. There aren’t enough of them to make a noticeable difference in the general trend.

Which, again, is toward fewer, bigger banks.